25+ Roth 401k calculator 2021

Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. 6650 month in retirement Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k.

The Case Against Roth 401 K Still True After All These Years

Not everyone is eligible to contribute this.

. Traditional 401k or Roth IRA Calculator Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool. Access Schwab Professionals 247. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year.

We stop the analysis there regardless of your spouses age. For those age 49 and under the limit is 61000 in 2022 up from 58000 in 2021. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Traditional and Roth IRAs give you options for managing taxes on your retirement investments. The contribution deadline for Roth IRAs for a particular tax year is usually the filing deadline for that year. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You.

It is mainly intended for use by US. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement.

Discover Fidelitys Range of IRA Investment Options Exceptional Service. For 2022 the maximum annual IRA. Roth 401 k contributions allow you.

We assume you will live to 95. It provides you with two important advantages. Traditional 401 k and your Paycheck A 401 k can be an effective retirement tool.

As of January 2006 there is a new type of 401 k contribution. The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. Unlike taxable investment accounts you cant put an.

Subtract from the amount in 1. Traditional vs Roth Calculator Contributions to a Traditional 401 k or individual retirement accounts are made on a pre-tax basis resulting in a lower tax bill and higher take-home pay. 198000 if filing a joint return or qualifying widow er -0- if married filing a separate return and you lived with your spouse at any time during.

This calculator assumes that you make your contribution at the beginning of each year. The amount you will contribute to your Roth IRA each year. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

You can adjust that contribution down if you. So for your 2021 income taxes you can contribute to your Roth IRA up. Discover Fidelitys Range of IRA Investment Options Exceptional Service.

As of January 2006 there. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. There is an upper limit to the combined amount you and your employer can contribute to defined 401 ks.

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. Get The Flexibility Visibility To Spend W Confidence. We automatically distribute your savings optimally among different.

The Benefits Of A Backdoor Roth Ira Financial Samurai

Social Security And Taxes Could There Be A Tax Torpedo In Your Future Apprise Wealth Management

Sum Of Year Digits Method Of Depreciation How To Calculate With Example

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Operating Cash Flow Formula Examples With Excel Template Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

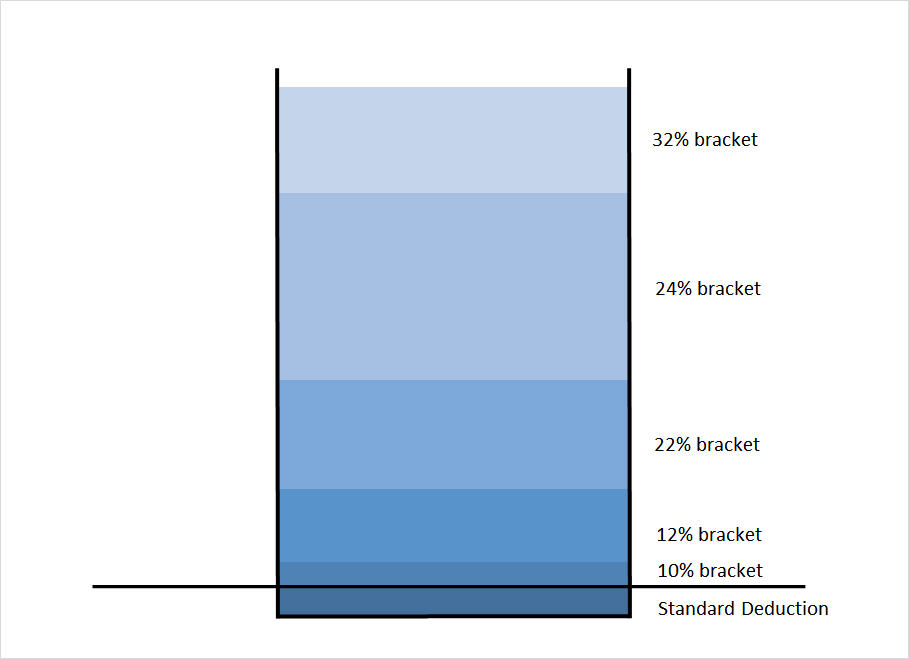

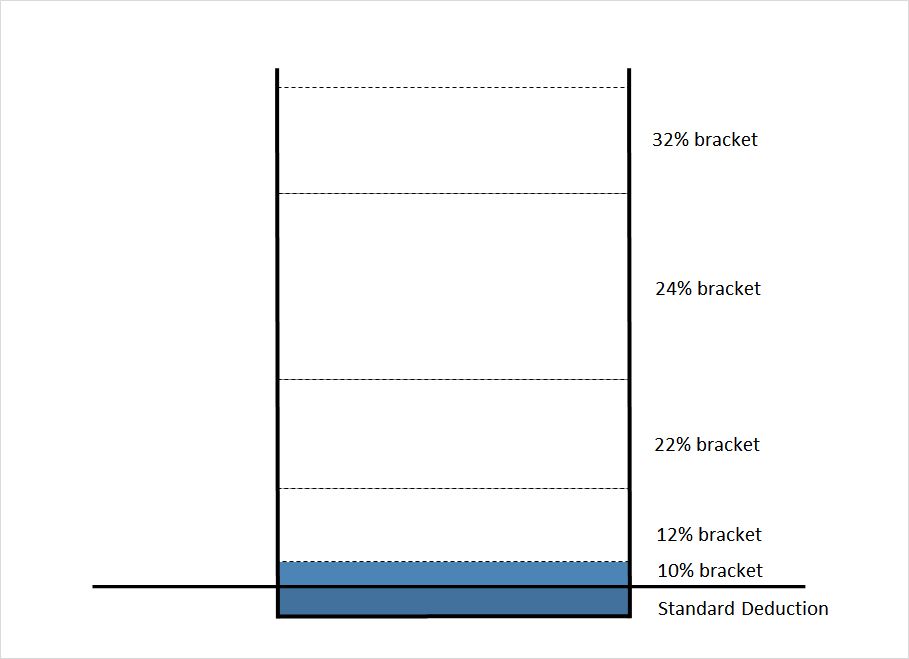

The Case Against Roth 401 K Still True After All These Years

Contribute To My 401k Or Invest In An After Tax Brokerage Account

The Case Against Roth 401 K Still True After All These Years

How Much Should A 42 Year Old Invest In Roth Ira Monthly For How Long And Can I Open An Account For Kids 7 5 And 1 How Much And How Long Is There

Net Asset Formula Examples With Excel Template And Calculator

401k To Roth Ira Conversion Rules Taxes Limits

Contribute To My 401k Or Invest In An After Tax Brokerage Account

New Jersey Secure Choice Faqs Fisher401k

The Benefits Of A Backdoor Roth Ira Financial Samurai

The Benefits Of A Backdoor Roth Ira Financial Samurai